tax on unrealized gains uk

What this means is that someone who owns stock or property that increases in value. But its not the bullying scandal that forced Gavin Williamson to quit the new premiers Cabinet.

Double Taxation Of Corporate Income In The United States And The Oecd

The same as for 2021 to 2022 - 12300.

. By Georg Grassmueck President Bidens proposal to require roughly 700 US. Total profits are the aggregate of i the companys net income from each source. The way its currently structured the tax would affect the richest 700 Americans forcing them to include unrealized gains as part of their annual income.

If you hold an asset for less than one year and sell for a capital gain the difference between your purchase price and your sale price will be subject to short-term capital gains. The top 1 paid an average individual rate of 254 which is more than seven times the rate the bottom 50 paid according to the Tax Foundation. According to the Congressional Budget Office the top one percent of earners paid 417 percent of income taxes in 2018 and 259 percent of federal taxes.

Corporate - Income determination. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by.

If the asset is jointly owned with another person its possible to use both. The sale price is 100 the basis is 100. A UK resident company is taxed on its worldwide total profits.

If youre single and all your taxable income adds up to 40000 or less in 2020 then. Your granddaughter can sell that share of stock at 100 and pay no taxes since in the eyes of the law she didnt make any money on it. If you decide to sell youd now have 14 in realized capital gains.

The tax laws include a 0 tax bracket on long-term capital gains up to a certain amount of total income. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of. In 2021 to 2022 the trust has gains of 7000 and no losses.

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022. 1 day agoHunt is thought to be looking to cut household energy bills support from 60bn to just 20bn from April and his plans could include an extended freeze on income tax and national. Then multiply the gain or loss per unit by the total units of the investment to get the total unrealized.

If the amount is negative it means that your asset has decreased in value. Unrealized gains are not taxed by the IRS. The top 20 percent of.

Currently the tax code stipulates that unrealized capital gains arent taxable income. In the United States unrealized gains are not taxable until they have been sold and unrealized losses do not have a tax benefit until theyve been realized. This means you dont have to report them on your annual tax return.

For example if you bought a painting for 5000 and sold it later for 25000 youve made a gain of 20000. Tax unrealized capital gains at death for unrealized gains above 1 million 2 million for joint filers plus current law capital gains exclusion of 250000500000 for primary. Capital gains are only taxed if they are realized which means.

And then there are tax rates. 19 hours agoThe Capital Gains Tax rates and allowances for 2022 are. Its the gain you make thats taxed not the amount of money you receive.

Rishi Sunaks UK Conservatives are in a state of shock this week.

Taxation Of Capital Gains For Individuals And Companies Taxation

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Taxation Of Capital Gains For Individuals And Companies Taxation

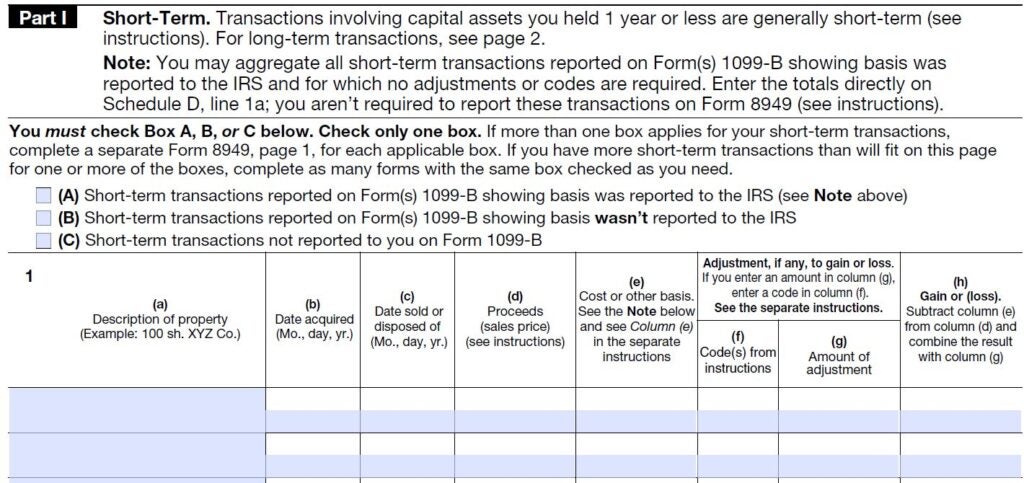

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

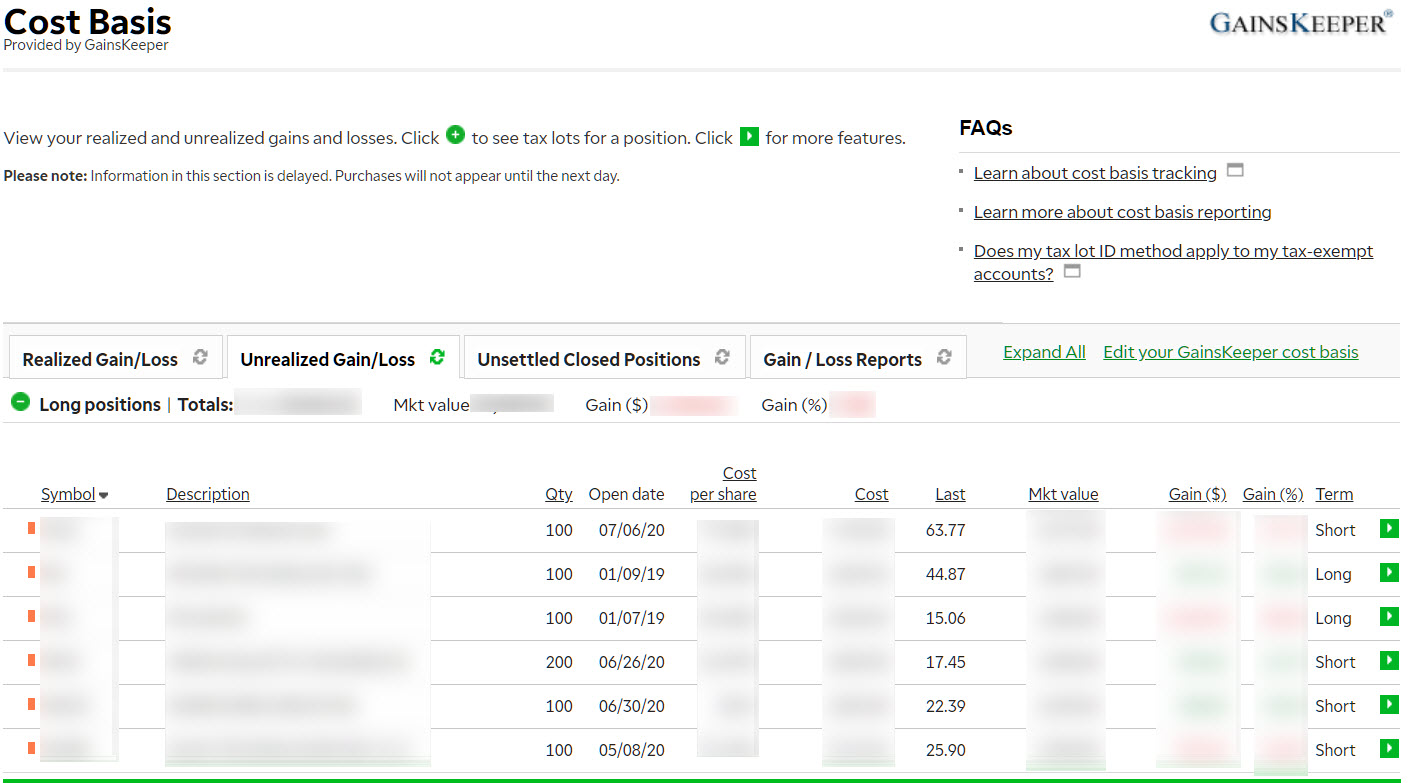

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Is Your Alpha Big Enough To Cover Its Taxes A 25 Year Retrospective Research Affiliates

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Crypto Tax Loss Harvesting Investor S Guide Koinly

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Forex Trading Academy Best Educational Provider Axiory

Golar Lng Limited 2022 Q2 Results Earnings Call Presentation Nasdaq Glng Seeking Alpha

Capital Gains Tax Help Trading 212 Community

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

How To Optimize Your Investments For Skat Saving Taxes In Denmark Your Green Wealth

Is Your Alpha Big Enough To Cover Its Taxes A 25 Year Retrospective Research Affiliates

2022 Ultimate Crypto Tax Guide Defi Cefi And Nfts Accointing Crypto Blog Knowledge Crypto Taxes Guides Tips