portability estate tax exemption

Currently the limit is set at 1158 million in combined assets for a decedent who dies in 2020 and is expected to remain at this level until at least 2025. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Exploring The Estate Tax Part 2 Journal Of Accountancy

Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the.

. For 2019 the exemption has been adjusted for inflation to 114 million per taxpayer and 228 million per married couple. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate tax for 2021. Thanks to the portability rule the survivor can use whats left.

However by applying for portability of the first to dies unused exemption when heshe passes away the surviving spouse can use the 9580000 unused exemption amount plus their 11580000 exemption amount to make the 568000 tax go away. In order to elect portability a surviving spouse must file an estate tax return Form 706 for the federal estate tax and Form MET-1 for the Maryland estate tax. The non-exempted amount of 545 million would be portable and would be passed to his wife.

Portability is a federal exemption. The option of portability can make a significant difference when it comes to taxation of an estate. As of 2021 the federal estate tax exemption is 114 million.

This is true even if you live in a state that. In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely. The tax for the estate would be 568000 at a 40 tax rate.

That gives the couple a total exemption of more than. The portability feature means that when one spouse dies and his or her estate value does not use up to the total available estate tax exemption the unused portion of the estate tax exemption is then added to the available estate tax exemption for the. A surviving spouse can get a big federal estate tax break if the deceased spouse didnt use up his or her individual estate tax exemption.

Lastly one important limitation on portability is that it only applies to the estate and gift tax exemption. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. Portability in Estate Tax Exemptions.

Estate tax return preparers who prepare a return or. Estate and gift taxes are affected by the principles of portability and they are a part of a group of taxes known as federal transfer taxes. Estate tax gift tax and generation-skipping transfer GST tax.

Furthermore more and more states have state estate tax exemptions that are less than the federal estate tax exemption. Electing to use estate tax portability makes a significant difference in your federal estate tax liability. If the portability election is filed in time the entire estate of 60 million will be named under the wife.

You will want to be aware that portability may not be the right decision for your situation if for example you choose to divide. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the unused exemption and add it to the surviving. On top of this generous amount the IRS also allows for portability of the exemption between spouses.

The portability of the federal estate tax exemption for married couples eliminated the need to plan in such a way. Hawaii and Maryland are two of the few states that allow portability of their state estate tax exemption. While most states dont have an estate tax some do.

Theres another important exemption from generation skipping transfer tax or GST tax and that is an exemption that allows transfers to grandchildren and further descendants without that additional GST tax or gift and estate tax. All of these taxes impact the amount of money passed to an individuals. There are three distinct but related federal transfer taxes.

Portability has been retained since then so the surviving spouse would have a total exclusion of 2316 million using the figures that are in place for 2020. The Tax Relief Unemployment Insurance Reauthorization and Job Creations Act of 2010 introduced for the first time the concept of portability of the federal estate tax exclusion between spouses. Thus while your surviving spouse might not be subject to federal estate tax upon your passing your surviving spouse may have to pay significant state estate tax if you rely solely on the federal exemption portability.

Portability is the term used to describe a relatively new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his or her deceased spouse to shelter assets from gift tax during the surviving spouses life andor estate tax at the surviving spouses death. Each year the government sets a tax exemption limit or exclusion amount for estates under a certain size. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within 270 days after her husbands death.

When a tax reform measure was enacted in 2011 the estate tax exclusion became portable between spouses. Why You May Want to Transfer Your Unused Estate Tax Exemption to Your Spouse December 17 2019 by Cathy Lorenz. When enacted it was meant to apply only to.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. In effect portability increases the 2nd to dies. How does the Federal Estate Tax Exemption work.

Two important aspects to remember are that the portability exemption is only available to married couples and only applies to Federal estate taxes.

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Filing For Homestead Exemption In Florida Florida Homesteading Real Estate Information

Taxation And Initial Coin Offerings Time And Time Again I Talk To Companies That Are In The Middle Of An Ico And The Way The Initials Coins Columbia Maryland

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

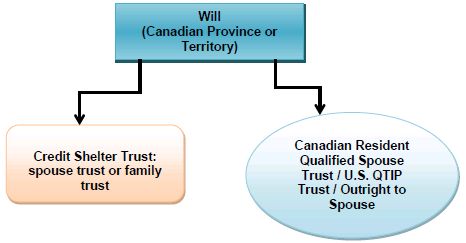

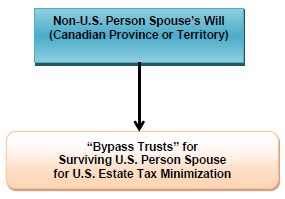

Will And Estate Planning Considerations For Canadians With U S Connections Tax Canada

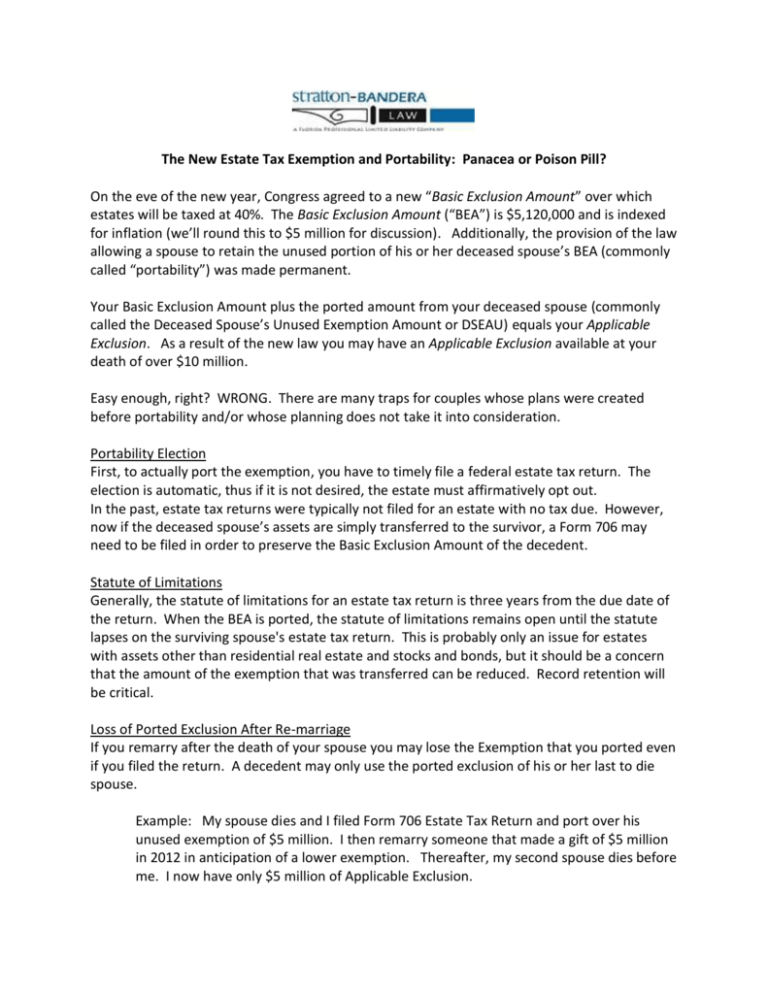

The New Estate Tax Exemption And Portability Panacea Or Poison

Tax Related Estate Planning Lee Kiefer Park

Free H1z1 Keys Tickets And Br Places To Visit I Am Awesome Places To Go

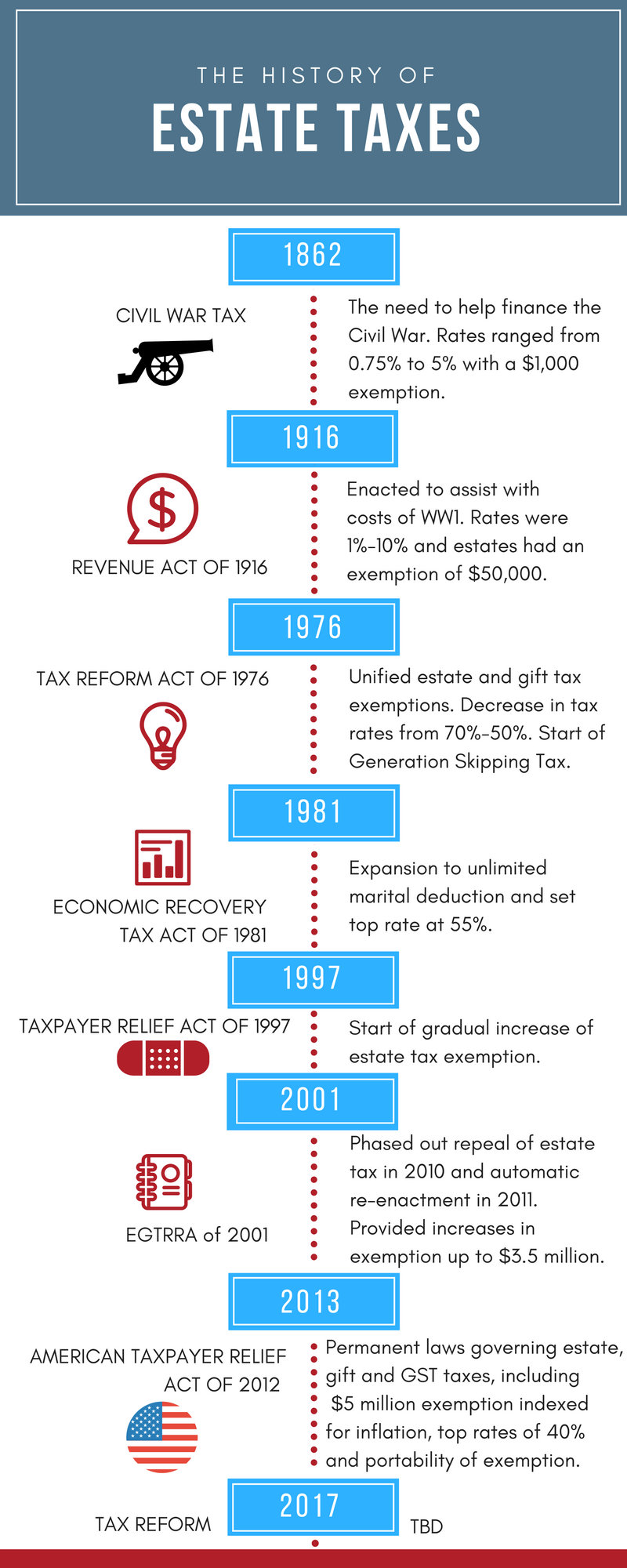

A Brief History Of Estate Gift Taxes

Don T Forget About Making A Portability Election Capell Howard P C

Free H1z1 Keys Tickets And Br Places To Visit I Am Awesome Places To Go

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group Estate And Probate Legal Group

A Trust May Be Taxed As Either A Grantor Trust Or A Nongrantor Trust Each Type Of Trust Has Advantages And Disadvanta Estate Tax Estate Planning Grantor Trust

Will And Estate Planning Considerations For Canadians With U S Connections Tax Canada

Is Ab Trust Planning Still Effective

Pin By Debbie Wolfe On Trusts Revocable Trust Living Trust Estate Tax