tax saver plan in post office

Most banks require you. 5 00-Sukanya Samriddhi Account.

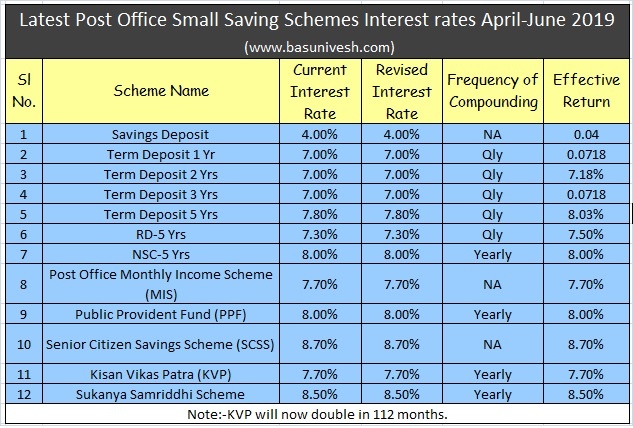

Latest Post Office Small Saving Schemes Interest Rates April June 2019 Basunivesh

Tax Saver Commuter Tickets is an initiative of the Revenue Commissioners whereby Section 118 5A TCA 1997 exempts employees and directors from benefit-in-kind taxation where an expense has been incurred by an employer on the provision of a monthly or annual bus or train pass for the employee or director.

. Is applicable on the deposits in the post office account. Regular mail through the post office. Minimum balance in respect of different types of Small Savings Accounts is given below.

Leave in the drop-box at the Township Administration Building 455 Hoes Lane and Piscataway. Our office will be closed on Monday February 21 2022 in observance of the holiday. Risk-free and Reliable Investment.

There are schemes such as the National Saving Certificate that. 500000 1000000 500000 100000 Add 5 of Rs. Any claim received after 300 pm is considered to be received the following business day.

As an example a claim received Monday prior to 300 pm CST will be processed at the end of business Wednesday and entered into your TaxSaver Plan account Thursday morning prior. Individuals who have retired under VRS Voluntary Retirement Scheme or on superannuation and belonging to the age group of 55-60 can also invest in this scheme. Regardless of any other related parameters the post office saving schemes are government-backed and therefore are the safest and risk-free investment avenue to park the funds.

What is the minimum amount needed to open a Tax Saver FD account. Total Tax on Income. 200000 500000 300000 10000.

The key acknowledged highlight of post office saving schemes is tax efficiency. The key acknowledged highlight of post office saving schemes is tax efficiency. Post office tax saving scheme.

This post office tax saving scheme as the name suggests is implemented for senior citizens. 7 rows Types of Post Office Saving Schemes for Tax Benefits. Minus Deduction of Interest on Bank Savings Post Office under Section 80TTB for Senior Citizens 50000 Net Taxable Income.

If you do an investment in the five-year term plan then this qualifies for the tax benefit under Section 80C. Savings Schemes Under Post Office Investments Post Office Savings Account. 500-National Savings Recurring Deposit Account.

Post Office Savings Account. Tax on Net Taxable Income. With over 40 years of experience TaxSaver Plan has unparalleled expertise in compliance standards to equip you.

An interest rate of 4 pa. The minimum deposit to open a post office savings account is Rs 500. 10 rows Yes most of the post offices savings schemes give tax deductions of up to Rs 15.

This Post Office Fixed deposit comes with the provision of being transferable from one Post office to another. Tax saver plan in post office. Checks or money order only Property Tax Reimbursement Form PTR submissions.

Regular mail through the post office. Risk-free and Reliable Investment. Post Office Savings Account.

Leave in the drop-box at the Township Administration Building 455 Hoes Lane and Piscataway. A post office fd is a post office savings scheme that qualifies for tax saving up to rs 150000 under section 80c of the income tax act 1961. According to Section 80TTA interest income earned from savings accounts including Post Office Savings Account is eligible for deduction of Rs.

Regardless of any other related parameters the post office saving schemes are government-backed and therefore are the safest and risk-free investment avenue to park the funds. The key acknowledged highlight of post office saving schemes is tax efficiency. 900000 1900000 1000000 Rs.

Simplified efficient dependable benefits administration. The domestic customer can open the account in single or joint ownership. Senior Citizen Savings Scheme SCSS This Post Office tax saving scheme as the name suggests is implemented for senior citizens.

There are schemes such as the National Saving Certificate that. Tax Saver Commuter Scheme Explained. FAQs on Tax Saving Fixed Deposits.

100-Monthly Income Scheme INR.

Post Office Saving Schemes Tax Saving Plans Interest Rate In 2022 Benefits Plan Comparison

Latest Post Office Small Saving Schemes Interest Rates July Sept 2019 Basunivesh

Post Office Saving Schemes Revised Interest Rates From 1 Apr 2014 Post Office Schemes Post

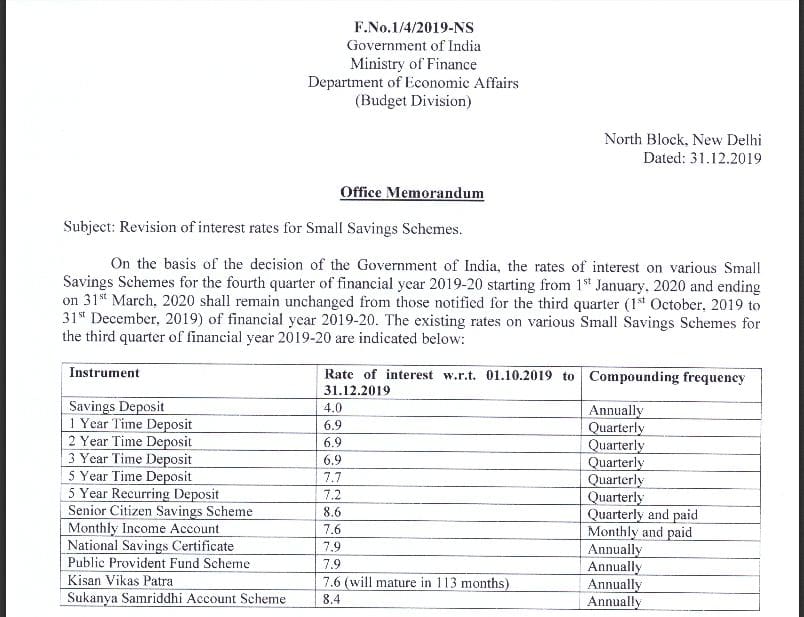

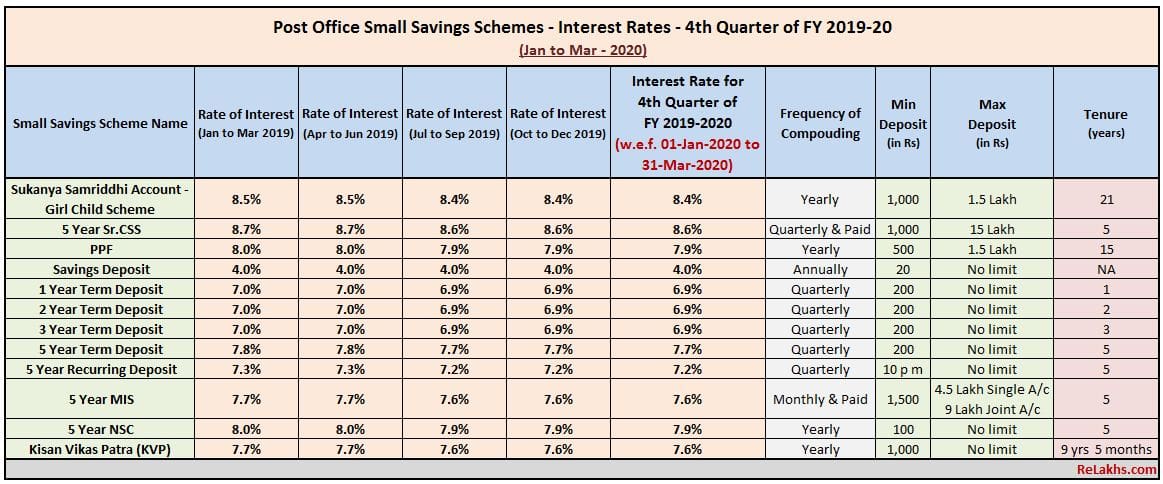

Post Office Small Saving Schemes Interest Rates Jan Mar 2020

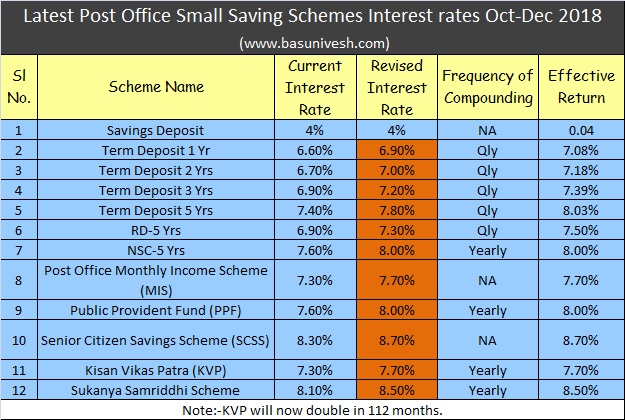

Latest Post Office Small Saving Schemes Interest Rates Oct Dec 2018 Basunivesh

Latest Post Office Interest Rates April June 2021 Basunivesh

Post Office Small Saving Schemes Interest Rates Jan Mar 2021

Post Office Savings Account 2021 Interest Rate Eligibility Documents Kyc

Latest Post Office Interest Rates April June 2021 Basunivesh

Latest Post Office Small Saving Schemes Interest Rates Jan Mar 2020 Basunivesh

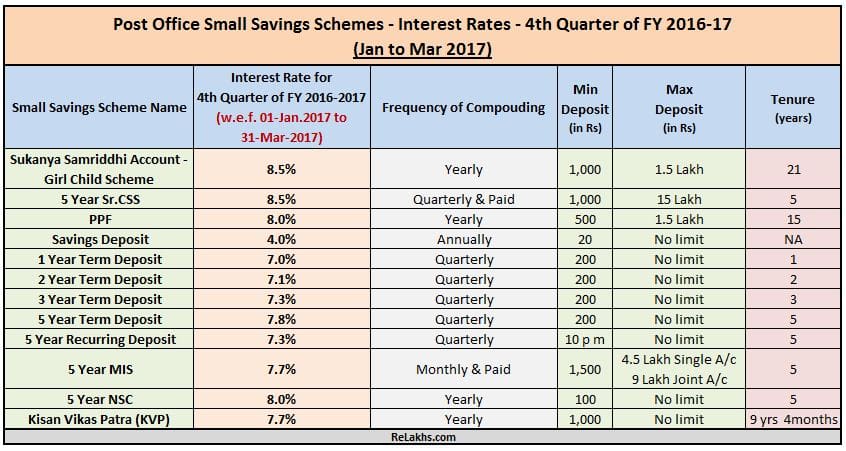

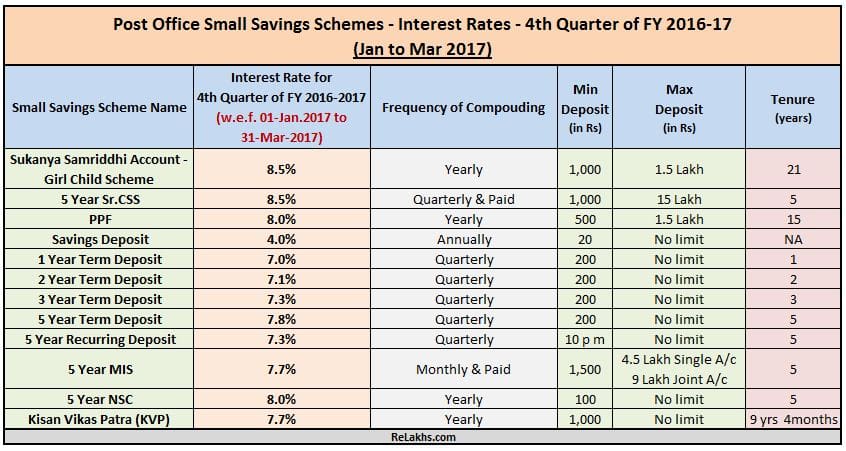

Post Office Small Saving Schemes Interest Rates 2016 2017

Post Office Small Saving Schemes Interest Rates 2016 2017

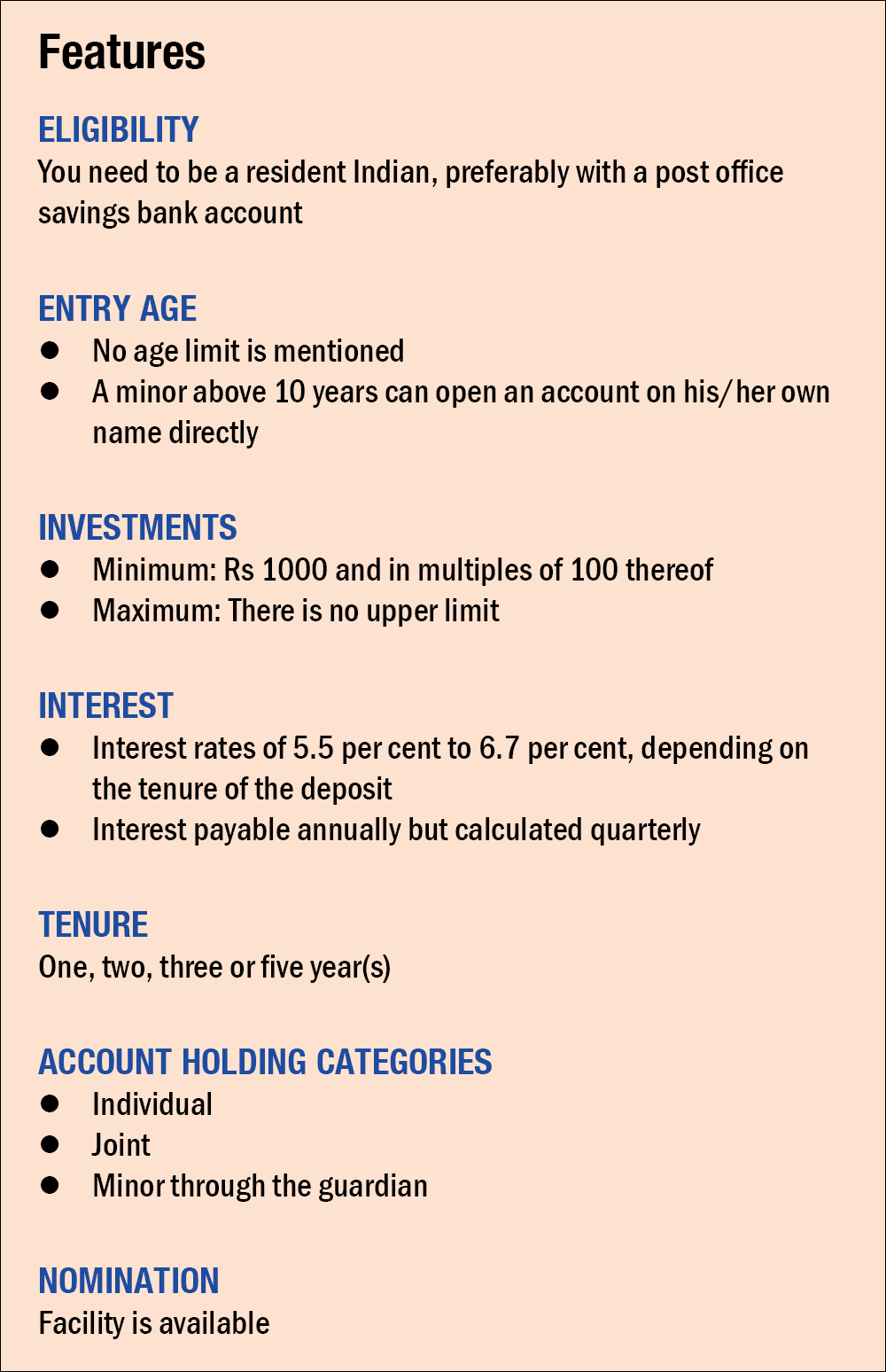

All About The Post Office Term Deposit Value Research

Latest Post Office Small Saving Schemes Interest Rates Jan March 2018 Basunivesh

Post Office Time Deposit Td Scheme Giving Lucrative Interests On Fixed Term Goodreturns

Post Office Saving Schemes For Boy Child In India

Post Office Ppf Account Interest Rate Eligibility Benefits

Post Office Small Saving Schemes Interest Rates Jan Mar 2020